Managing money doesn’t have to feel like a never-ending chore, and you definitely don’t need a finance degree to get it right.

With a few clever financial life hacks up your sleeve, you can simplify money management, cut out stress, and even get excited about staying organized.

These tips will help you build better habits, spot hidden savings, and sometimes even discover cash you didn’t know you could be making right now.

Quick Money Making Ideas:

$100 Bank Bonus Offers – Many major banks will incentivize you to open a checking and savings account with them. It’s an easy way to make a quick $100 or $300 fast for completing a few simple requirements.

FreeCash – I use this site to make quick cash in my free time. It’s an easy way to add to your savings or grab lunch without dipping into your paycheck.

Financial Life Hacks to Take Control of Your Money

Here are some financial tips I wish someone had shared with me in my 20s. They’ll help you make smarter moves now and set yourself up for more freedom, faster.

1. Play the Tax Game Like the Wealthy Do

My old boss was a multi-millionaire and he once told me something I’ll never forget. He said the real secret to wealth is knowing tax strategies because that’s how you actually keep more of your money.

Most people treat taxes like a once a year chore, but the smart ones use it as a tool. Contribute to retirement accounts, write off legit expenses if you have a side hustle, and claim every credit you qualify for.

Action: Keep up with new tax laws because they change all the time and the updates can save you thousands.

2. Invest in Fractional Real Estate

One of the easiest financial life hacks is putting your money to work so it earns for you while you sleep. Real estate has always been a powerful way to do that, but most people think you need hundreds of thousands of dollars to get started.

What most people don’t realize is you can now invest in fractional real estate and own a piece of big projects without having to buy an entire property yourself. Not only can you collect dividends along the way, but you also benefit from property appreciation over time.

Action: Sign up for Fundrise where you can start investing in real estate with as little as $10 and even get a $25 sign-up bonus to kick things off.

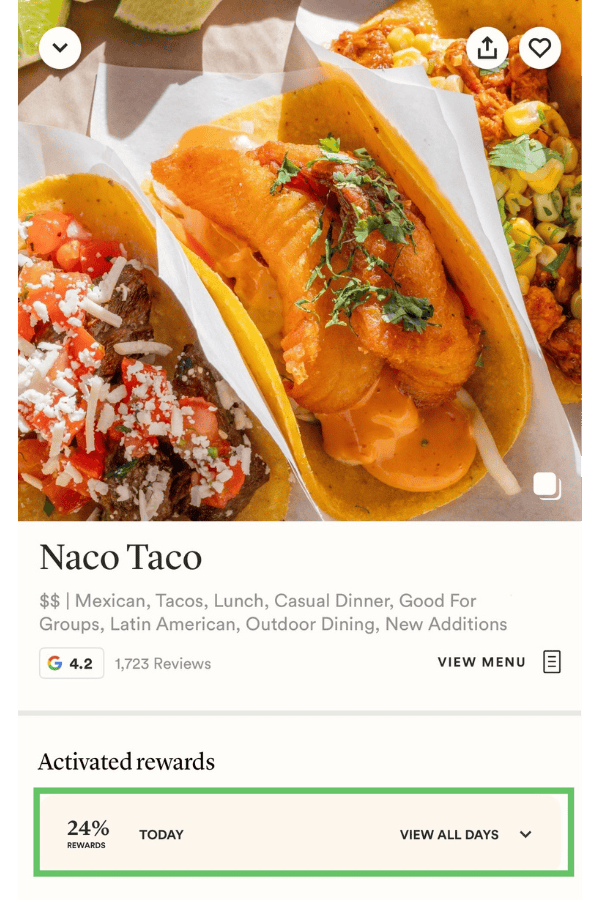

3. Eat Out Smarter With Money-Saving Apps

Eating out doesn’t have to blow your budget. I use apps like Seated and TooGoodToGo. They make it easy to enjoy a nice meal without overspending.

Seated rewards you with gift cards when you book through their app, and TooGoodToGo lets you grab surprise bags of food from restaurants at a fraction of the price. It’s a simple hack that lets you enjoy dining out without the guilt of draining your wallet.

Action: Download Seated and TooGoodToGo. Try them the next time you’re craving a meal out. You’ll save money and still get to treat yourself.

4. Control Your Spending With the Envelope Method

The envelope method has been around for decades. The idea is simple. You set aside cash in different envelopes for specific expenses like groceries, eating out, or gas.

When the envelope is empty, that’s it, you wait until next month to refill it. It came about long before budgeting apps, but people still use it today because it works. Sometimes old-school tricks are the ones that keep you most disciplined.

Action: Try cash stuffing for just one category, like eating out, and see how much more intentional you get with your spending.

5. Cut Interest by Paying Your Mortgage Every Two Weeks

Most people pay their mortgage once a month, but splitting that payment in half and sending it every two weeks can shave years off your loan. By the end of the year, you’ll have made the equivalent of one extra monthly payment without really feeling it.

Over the life of the loan, that can save you a huge amount in interest. Not all lenders allow you to make biweekly payments, so you’ll want to check with yours first.

Action: Call your lender to see if they accept biweekly payments, and if not, set up an automatic extra payment once a year toward your principal.

6. Leverage Discount Gift Cards for Everyday Spending

Sites like Fluz or MyGiftCardsPlus sell gift cards for groceries, restaurants, or big box stores at a discount. Buying a $100 card for $90 is an instant 10 percent savings before you even shop.

It might not sound like much at first, but imagine stacking those savings on things you already buy every week. It’s like giving yourself a built-in coupon without clipping a single thing.

Action: Check Fluz or MyGiftCardsPlus (a Swagbucks site) before your next shopping run or gas fill-up and grab a discounted card. You’ll start pocketing savings right away.

7. Ask for a Credit Limit Increase (Without Spending More)

Asking for a credit limit increase can actually help your credit score if you use it the right way. When your available credit goes up but your spending stays the same, it lowers your utilization ratio, and that’s something credit bureaus love to see.

The key is to never treat the bigger limit like free money. Think of it more as a behind-the-scenes trick that makes your credit look stronger without you doing much.

Action: Call your credit card company or request an increase online. It only takes a few minutes and could give your credit score a nice lift.

8. Check Your Subscriptions Once a Quarter

It’s easy to lose track of all the subscriptions quietly draining your bank account. Streaming, apps, gym memberships, they add up fast when you’re not paying attention.

Taking a few minutes every couple of months to review what you’re signed up for can save you hundreds a year.

Action: Set a reminder on your phone once a quarter to check your subscriptions and cancel anything that’s not adding real value to your life.

9. Slash Your Grocery Costs With Simple Apps

Groceries are one of the biggest expenses for most families, but apps like Flashfood, Ibotta, and Fetch can cut that bill down in a big way. I’ve saved hundreds of dollars each year just by using them.

Flashfood lets you grab discounted food close to its best-by date, Ibotta gives you cash back on everyday items, and Fetch rewards you just for snapping a picture of your receipts. I even use social media to share my Flashfood finds, which helps me rack up credits and snag free groceries.

Action: Download Ibotta, Fetch and Flashfood. Scan your receipts, check for deals, and watch the savings pile up week after week.

10. Use Trusts to Protect Assets and Access Cash

Wealthy people often put their assets, like real estate or investments, into a trust. It keeps those assets safe, makes passing them down easier, and can even lower taxes.

The real hack is that you don’t always have to sell what’s inside the trust to get money. You can borrow against it instead. That way your assets keep growing while you use the loan to invest in something new.

Action: If you own property or investments, talk with a financial advisor about setting up a trust and how you might use it to access cash without giving up your assets.

11. Cut Your Taxes by Starting a Business

One of the biggest hidden financial life hacks is that the moment you start a real business, the tax game changes in your favor. Even if you only sell one product or service, you open the door to deductions that regular employees can’t use.

Things like part of your internet bill, phone, mileage, home office space, or certain meals can become legitimate write-offs when tied to your business. You’re basically shifting everyday expenses into tax advantages, which means you keep more of your money.

Action: If you’ve ever thought about selling something, make it official. Register your business, keep good records, and talk to a tax pro about what you can legally write off. Read more about the best small businesses to start.

12. Grow Your Money With a High-Yield Savings Account

Most big banks pay you pennies in interest, but online banks and credit unions usually pay way more, sometimes 10 to 15 times as much. One of my favorites is DCU, a credit union that not only offers strong rates but also gives sign-up bonuses for new members.

Keeping your savings in a separate account like this makes it harder to dip into, so you’re less tempted to spend it. Over time, that higher interest plus the bonus adds up to real money.

Action: Open a high-yield savings account at a credit union or online bank like SoFi, and move a portion of your savings there to start growing it faster.

13. Negotiate Your Bills Once a Year

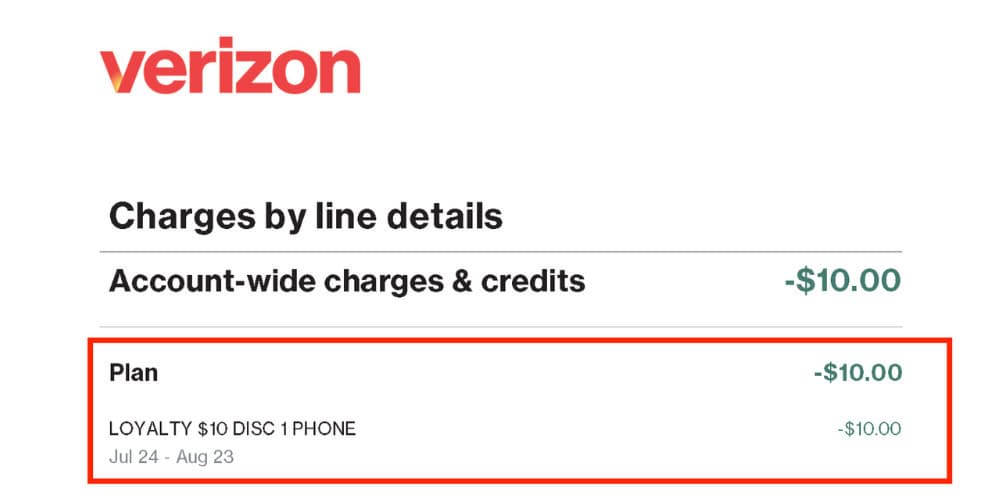

Most people pay their phone, internet, or insurance bills without thinking twice, but these companies often have discounts and promotions if you just ask. A five-minute phone call to your provider could knock $20 to $50 off your monthly bill.

Over a year, that’s hundreds of dollars back in your pocket without changing your lifestyle at all. The trick is to call once a year and ask if there are any current deals or lower rates available for loyal customers.

Action: Pick one bill today, your phone, internet, or insurance, and call to ask if they can lower your rate. I was able to get $10 off per month on my Verizon bill!

14. Get Paid to Eat With Mystery Shopping

One of the most fun financial life hacks I’ve tried is mystery shopping. Companies will actually pay you to eat at restaurants, shop at stores, and give honest feedback on your experience.

These mystery shopper jobs cover the cost of your meal or purchase, and on top of that you get paid for your time. It’s a smart way to treat yourself without blowing your budget, and I’ve even turned it into a steady side hustle.

Action: Check out my blog post on how I made $500 my first month as a mystery shopper to see exactly how you can get started.

15. Save Money by Living Abroad Temporarily

One of the smartest hacks I’ve seen people use is taking advantage of countries where the cost of living is much cheaper than the U.S. Places like Thailand, Bali, or Colombia let you live well for a fraction of what you spend at home.

If you rent out your house or apartment while you’re away, you can often cover your housing costs back home and sometimes even make extra profit. That extra cash can pay for your stay abroad, turning what looks like a vacation into a money-saving move.

Action: Look into short-term rental options for your home and compare them to the cost of living in countries with lower expenses. Also look into ways to make money while traveling.

Final Thoughts on Financial Life Hacks

At the end of the day, money is really about learning the small tricks that add up in a big way. These financial life hacks are simple enough for anyone to try, and once you put a few into action you’ll start to see how much easier it is to keep more of your cash.

The key is to stay consistent and keep looking for ways to make your money work harder for you. I’ve shared the hacks that have made the biggest difference in my own life, and now it’s your turn to test them out.

When you’re ready, check out my next post where I show you sneaky ways to save money without even noticing it and a few fast methods to make $50 when you really need it.

- Financial Life Hacks to Take Control of Your Money

- 1. Play the Tax Game Like the Wealthy Do

- 2. Invest in Fractional Real Estate

- 3. Eat Out Smarter With Money-Saving Apps

- 4. Control Your Spending With the Envelope Method

- 5. Cut Interest by Paying Your Mortgage Every Two Weeks

- 6. Leverage Discount Gift Cards for Everyday Spending

- 7. Ask for a Credit Limit Increase (Without Spending More)

- 8. Check Your Subscriptions Once a Quarter

- 9. Slash Your Grocery Costs With Simple Apps

- 10. Use Trusts to Protect Assets and Access Cash

- 11. Cut Your Taxes by Starting a Business

- 12. Grow Your Money With a High-Yield Savings Account

- 13. Negotiate Your Bills Once a Year

- 14. Get Paid to Eat With Mystery Shopping

- 15. Save Money by Living Abroad Temporarily

- Final Thoughts on Financial Life Hacks